Hey! How is your New Year’s resolution going? Remember you said you were going to get your finances up this new year? Are you still going strong or you have thrown in the towel? Resolutions are very easy to make, the difficult part is following them through. So, if you are looking at your transaction history in the past three months and it’s making you doubt your ability to ever turn your finances around this year, guess what? You still can in this second quarter. Here are 5 smart money moves you can make this Q2 2025.

5 Smart Money Moves for Q2 2025

Refresh Your Budget

See how you didn’t like your transaction history in the first quarter? Now, take a close look at your budget and identify any unnecessary expenses. Are you subscribed to services you rarely use? Are you spending more than planned on non-essentials? Cut back where possible and redirect those funds into savings, investments, or debt repayment. Small adjustments can lead to major financial improvements.

Optimise Your Savings Against Inflation

The cost of living is through the roof. Prices of items keep changing every week due to inflation (inserts frustrated emoji) and it’s important to ensure your money isn’t losing value because of this. Instead of letting cash sit idle in a low-interest account, explore better savings options such as fixed deposit accounts, mutual funds, or treasury bills.

Take Advantage of Market Trends

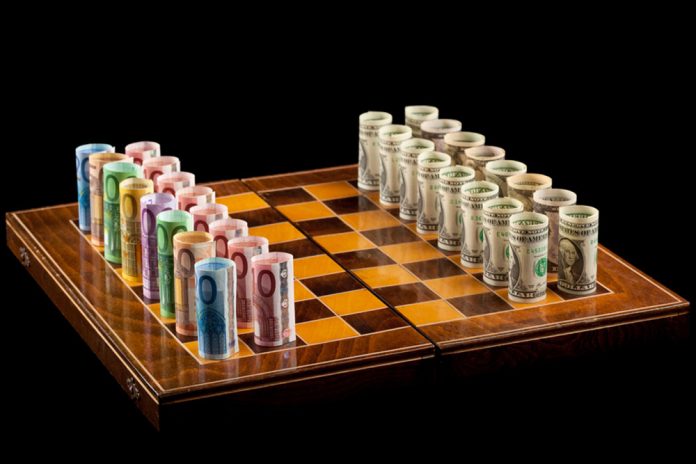

Economic and market trends fluctuate, but Q2 often presents unique opportunities for investors. If you’re investing, do your research and make informed decisions. Consider diversifying your portfolio, contributing more to retirement accounts, or exploring other investment options such as real estate or mutual funds. Staying updated on financial trends will help you make the most of available opportunities.

Plan Your Upcoming Expenses

Planning for expenses in Q2, like the summer holidays, major purchases or family celebrations can help you avoid financial stress. Start setting aside money now for big-ticket expenses to prevent last-minute financial strain. Look for discounts, early-bird deals, and budget-friendly alternatives to make your money go further.

Boost Your Financial Knowledge

They say knowledge is power, right? Exactly! The more you know, the better decisions you’ll make. Take time this quarter to enhance your financial literacy by reading personal finance books, listening to money-related podcasts, or attending webinars. Knowledge empowers you to manage your money more effectively and work towards financial independence.

Read Also: Light Up Your Fire